top of page

Search

Enhance your ESG Knowledge

What is SASB?

The Sustainability Accounting Standards Board (SASB) is an independent, non-profit organization that develops sustainability disclosure standards to help businesses communicate financially material sustainability information to investors. SASB focuses on identifying sustainability factors that are most relevant to financial performance, industry by industry. Before its integration into the International Sustainability Standards Board (ISSB) in 2022, the Sustainability Acco

EcoVision

Oct 30, 20252 min read

How TCFD Is Integrated into the ISSB Framework?

The Task Force on Climate-related Financial Disclosures (TCFD) has been a critical foundation for the development of global sustainability reporting standards. Its principles and structure have been directly integrated into the International Sustainability Standards Board (ISSB) framework to ensure a unified approach to sustainability and climate-related disclosures. The Task Force on Climate-related Financial Disclosures (TCFD) was officially disbanded on October 2023 . T

EcoVision

Oct 30, 20252 min read

Differences between "Sustainability" and "ESG"

While the terms "sustainability" and "ESG" are often used interchangeably, they represent distinct but related concepts. Little summary breakdown of their differences: 1. Sustainability Definition: Sustainability is a broad concept referring to the ability to maintain or endure something over the long term. In a business context, it involves meeting present needs without compromising the ability of future generations to meet their own needs. It encompasses environmental, s

EcoVision

Oct 29, 20251 min read

The Business Case For Net Zero Has Never Been Stronger

The report shows that 63% of the world’s largest publicly listed companies or 70% of the Forbes Global 2000 now have net zero goals. In short, commitment to net zero has become the corporate norm. Source: https://www.forbes.com/sites/maryjohnstone-louis/2025/09/26/the-business-case-for-net-zero-has-never-been-stronger/ #NetZero #GHGs #Carbon #Emissions #Corporate #Forbes

EcoVision

Oct 24, 20251 min read

The four key pillars of the TCFD framework

They are: 1. Governance, 2. Strategy, 3. Risk management, and 4. Metrics and targets. These TCFD four pillars guide organizations in disclosing their climate-related financial risks and opportunities by focusing on oversight, how the business plans to adapt, the processes used to manage risks, and the specific metrics used to measure progress.

EcoVision

Oct 23, 20251 min read

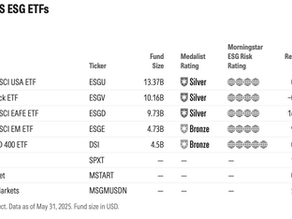

Five Largest US ESG ETFs

source: https://www.morningstar.com/sustainable-investing/five-top-esg-etfs-us-investors as of 31-May-2025

EcoVision

Oct 17, 20251 min read

Retail Green Bonds: Investing for a Greener World

source: https://www.ifec.org.hk/web/en/blog/2022/04/retail-green-bonds.page

EcoVision

Oct 16, 20251 min read

Record sales of green bonds in the first half of 2024

https://www.bloomberg.com/professional/insights/sustainable-finance/record-sales-of-green-bonds-in-the-first-half-of-2024/

EcoVision

Oct 16, 20251 min read

GHG Protocol, Scope 1, 2 & 3 Simple Diagram

Upstream (GHG Categories 1–8) Purchased goods and services – GHG Emissions from producing goods/services your company buys. Capital goods – Emissions from producing long-life assets you purchase (machinery, buildings, equipment). Fuel- and energy-related activities (not included in Scope 1 or 2) – Upstream emissions from fuels and electricity you use (well-to-tank, transmission losses, etc.). Upstream transportation and distribution – Third-party transport/storage of purc

EcoVision

Oct 15, 20251 min read

bottom of page